Do you know there is a tool that can help self-employed business owners transfer business assets to a corporation in exchange for shares, deferring taxes on capital gains?

The Section 85 rollover in Canada enables incorporation, protects personal assets, and supports future tax planning. Filing the T2057 form with the CRA is required, and professional advice ensures compliance and maximizes benefits.

What is Section 85 Rollover

A Section 85 rollover is a tax-deferred transfer mechanism under the Income Tax Act (Canada).

It allows self-employed business owners or individuals to transfer certain assets, such as those in a sole proprietorship or partnership, to a corporation in exchange for shares of the corporation, without triggering immediate tax consequences on the asset’s accrued gains.

Key Details

Purpose

- To incorporate a business while deferring taxes on gains associated with the transferred assets.

- Ensures continuity of ownership while transitioning from an unincorporated to an incorporated structure.

Eligible Assets

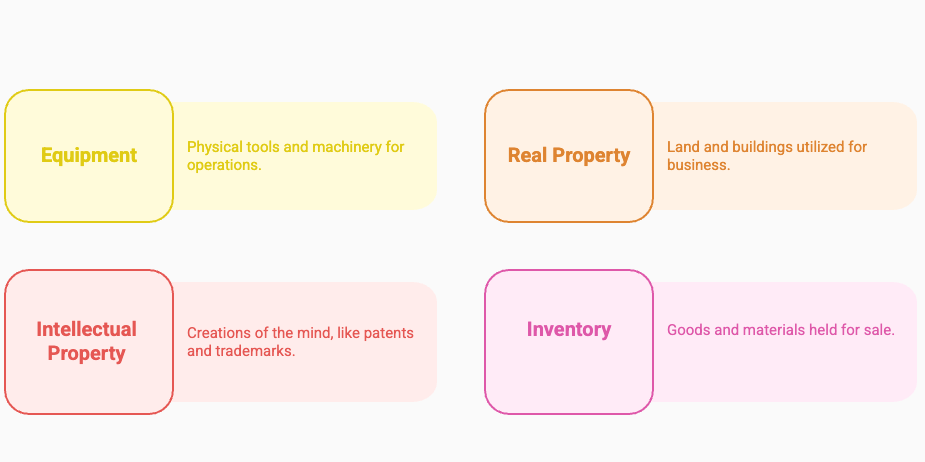

Common eligible assets include:

- Equipment

- Real property (used in the business)

- Intellectual property

- Inventory

Note: Accounts receivable and certain liabilities may also be transferred, but cash cannot be rolled over.

How It Works

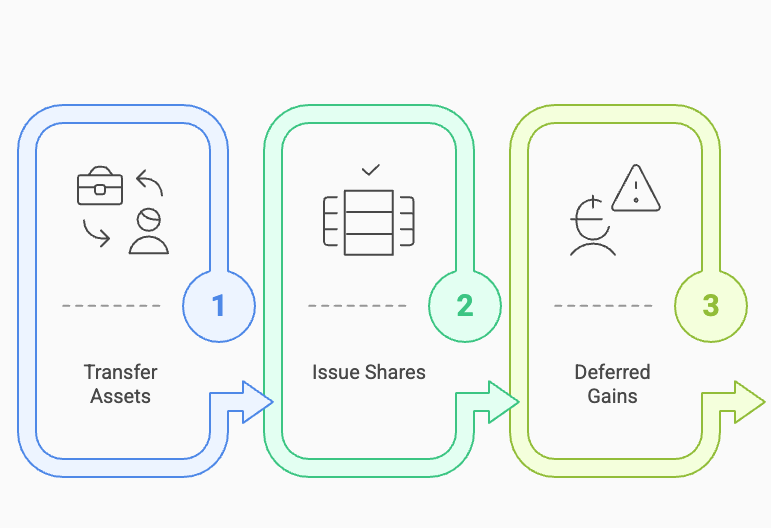

- You transfer the assets to the corporation at an agreed-upon value (usually the tax cost or a negotiated value between tax cost and fair market value).

- The corporation issues shares to you (or a combination of shares and other consideration like promissory notes).

- Any taxable gains on the difference between the adjusted cost base (ACB) of the asset and its fair market value (FMV) can be deferred.

Tax Deferral

- The tax is not eliminated; it is deferred until a later event (e.g., sale of shares or the business).

- The “rollover amount” or “elected amount” determines how much gain, if any, is recognized at the time of transfer.

Legal Requirements

- A Section 85 election form (T2057) must be filed with the Canada Revenue Agency (CRA). This outlines the details of the transfer, the elected amount, and other specifics.

- Both the individual and the corporation must sign the form.

Advantages

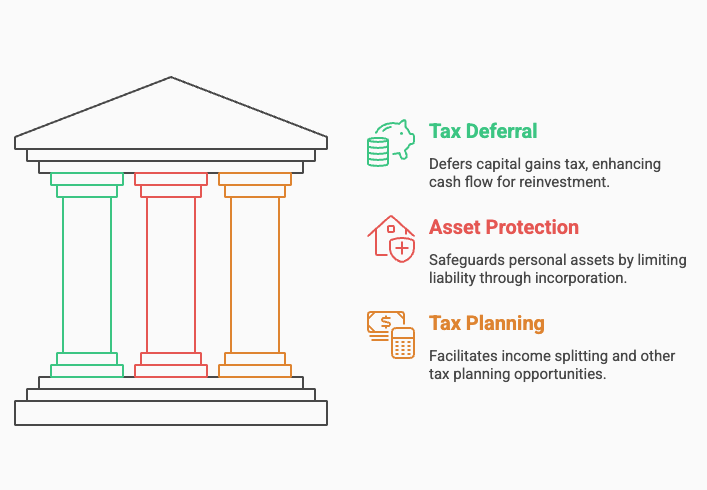

- Defers capital gains tax, improving cash flow for reinvestment.

- Protects personal assets by limiting liability through incorporation.

- Allows for income splitting or other tax planning opportunities in a corporate structure.

Considerations

- Proper valuation of assets is critical to avoid disputes with the CRA.

- Legal and accounting fees are typically incurred to ensure the transfer is compliant and tax-efficient.

- Future tax planning is required to optimize the eventual sale or disposition of shares.

Conclusion

Section 85 rollovers involve tax and legal complexities, making it essential to consult a tax advisor or corporate lawyer. They can help determine if the rollover is appropriate for your business, structure the transfer for maximum tax efficiency, and ensure all required forms are accurately prepared and filed.

This strategy is especially valuable for self-employed business owners looking to incorporate, expand, or eventually transition their business.

Reach out to us today to explore how a Section 85 rollover can benefit your business!