As a small business owner, you juggle various responsibilities, from managing operations to handling finances. One term you may have encountered is a “compilation engagement or report.” If you’re wondering what it is, how it differs from your QuickBooks Online financials or tax returns, and whether you need one, this guide is for you.

Who’s the introduction of compilation engagement/ report for?

-

Business owners and managers

-

Investors assessing financial statements

-

Anyone curious about financial reporting

Continue reading if you’re looking to understand…

- What is a Compilation engagement or report?

- Differences between a Compilation, QuickBooks Online financials, and tax return

- Engagement and reporting requirements

- Who can prepare a Compilation report?

- Contents of the report

Why does this matter to me? Understanding the Notice to Reader or Compilation Report matters because it sheds light on the financial health of a business. Whether you’re a business owner, investor, or simply interested in financial transparency, this blog will demystify its purpose.

What is a Compilation Engagement / Report?

A compilation engagement/report is a financial statement prepared by an accountant that presents information provided by a business in a structured format. Unlike audits or reviews, a compilation does not involve verifying the accuracy of the information or providing any assurance about its reliability.

Think of it as an organized, professional snapshot of your financial data, tailored for external users like lenders or investors who want to understand your business’s financial position.

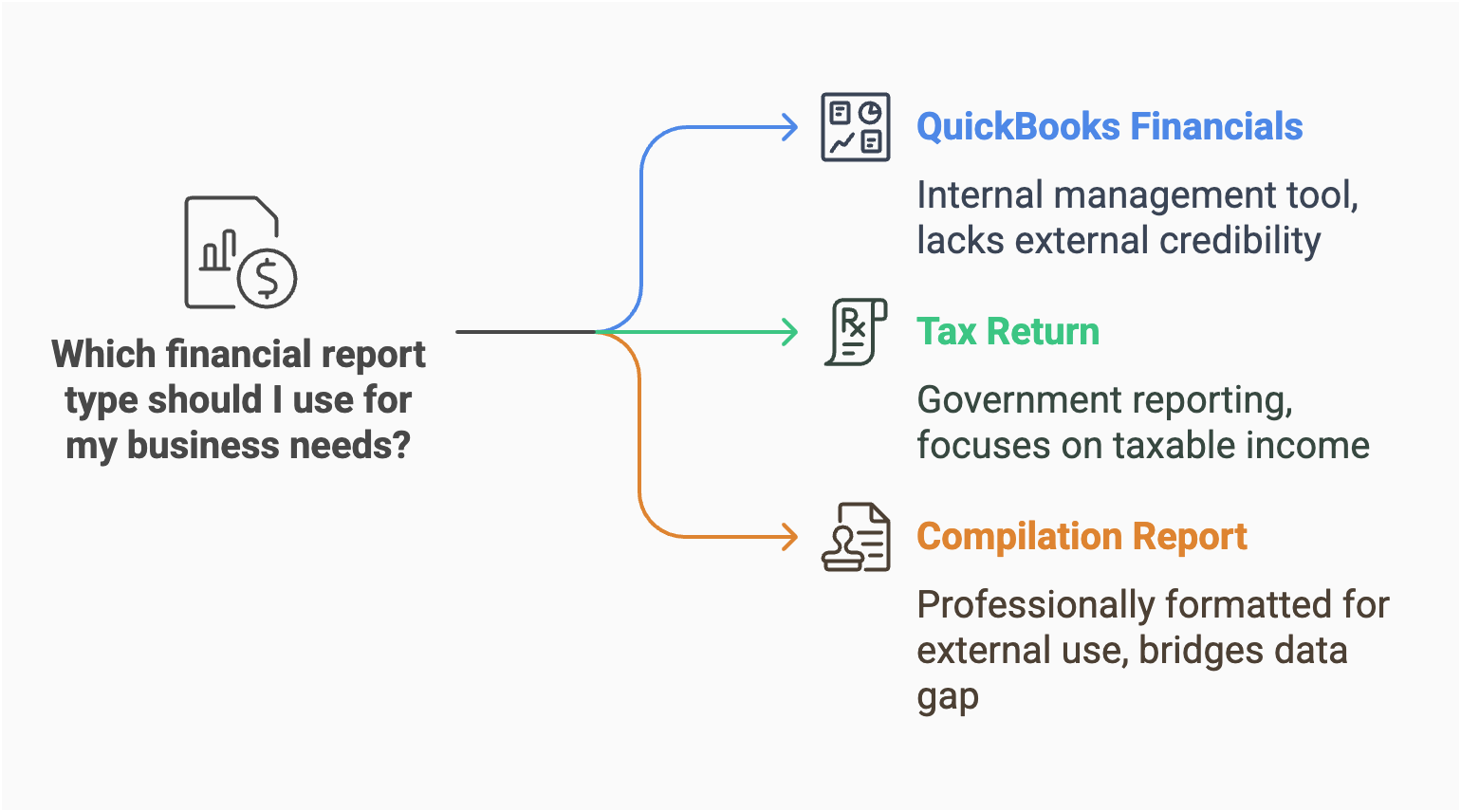

How is a Compilation Report Different from My QuickBooks Online Financials or Tax Return?

- QuickBooks Online Financials: The financial reports generated in QuickBooks (or other accounting software) are based on the transactions you’ve entered. These are internal tools meant for managing your business, and they often lack the professional formatting and credibility needed for external use. Therefore, proper financial closing procedures is important.

- Tax Return: A tax return focuses solely on your business’s taxable income and tax liabilities. It’s prepared for government reporting purposes, not for analyzing the overall financial health of your business.

- Compilation Report: A compilation report bridges the gap between raw data and professionally formatted financial statements. It’s designed to meet external parties’ requirements without delving into the deeper assurance processes involved in audits or reviews.

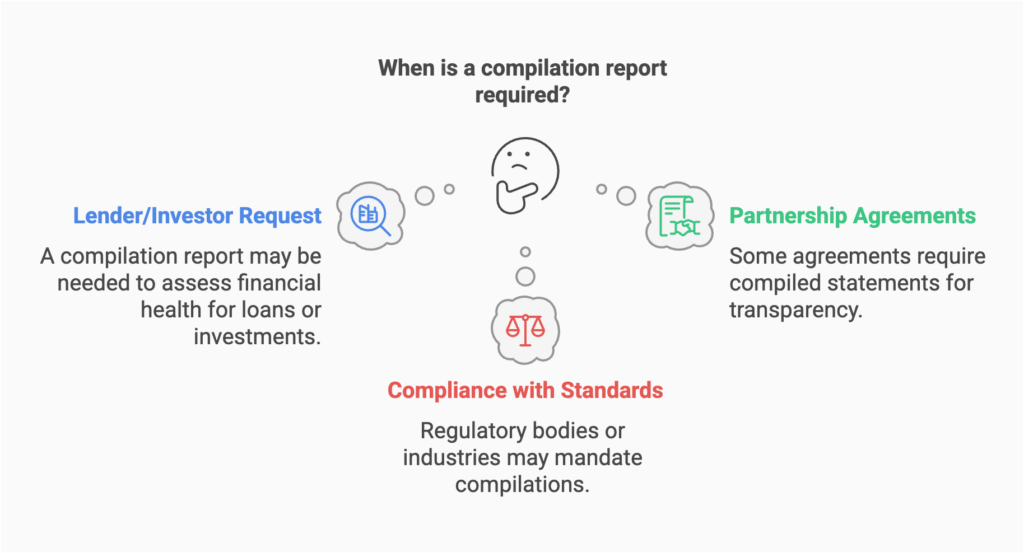

When am I Required to Get a Compilation Report?

You might need a compilation report in the following situations:

- Lender or Investor Requests: If you’re applying for a loan or bringing in investors, they may require a compilation report to assess your financial health.

- Partnership Agreements: Some agreements may mandate compiled financial statements to ensure transparency.

- Compliance with Standards: Certain industries or regulatory bodies may require compilations for specific purposes.

Always check the requirements of the external party you’re dealing with to confirm whether a compilation report is necessary. If you’re a corporation in British Columbia, it’s also important to be aware of ongoing compliance obligations.

Can I or My Bookkeeper Prepare a Compilation Report?

No, a compilation report must be prepared by a qualified accountant, typically a CPA (Chartered Professional Accountant). While you or your bookkeeper can maintain your financial records and produce internal reports, only a professional accountant can issue a compilation report because it adheres to specific accounting standards.

What is Contained in a Compilation Report?

A standard compilation report includes:

- Accountant’s Report: A statement clarifying that the information is based on data provided by the business and that no assurance is given.

- Financial Statements: These usually include a balance sheet, income statement, and cash flow statement.

- Disclosures: Notes explaining the basis of accounting and any additional relevant information about the financial data.

The report aims to present your financial data clearly and concisely, making it easier for external users to understand.

Conclusion

A compilation report is a valuable tool for small business owners who need to present their financial information professionally. Investing in a compilation report can help you take your business to the next level by demonstrating financial transparency and professionalism.

If you’re unsure whether you need one or how to proceed, contact us today to guide you through the process.