Understanding the month-end close process is key to maintaining financial integrity, making informed business decisions, and staying compliant with regulations. Whether you’re looking to streamline your accounting or enhance your financial decision-making, this guide covers everything from reconciling accounts to finalizing your books. This blog outlines the essential steps to close your books each month, helping to streamline your accounting procedures. Let’s dive in!

What is a month-end close process for accounting?

The month-end close process is a series of accounting procedures that a company undertakes to ensure that all financial records for the previous month are accurate and up to date before closing out that month’s books. This process is important because it allows a company to produce accurate financial statements and reports, which are used for decision-making, compliance, and other purposes.

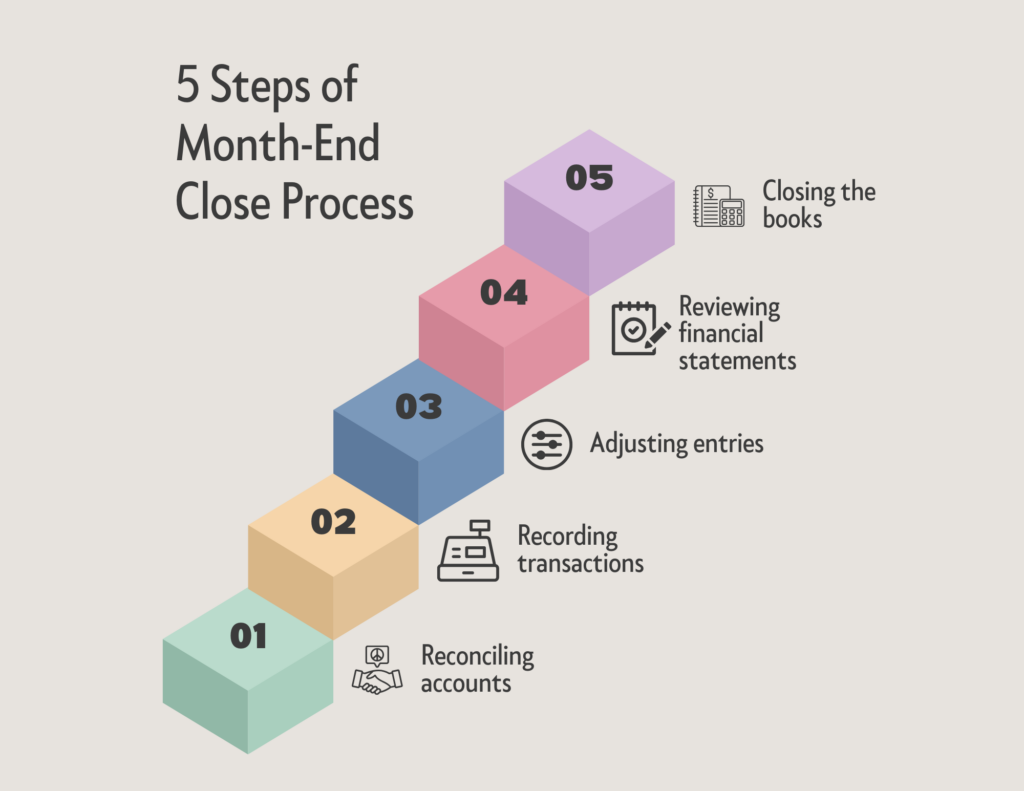

The month-end close process typically involves the following steps:

- Reconciling accounts: This involves comparing account balances in the general ledger with other records such as bank statements, accounts payable and accounts receivable, to ensure that they are accurate and consistent.

- Recording transactions: Any financial transactions that have not been recorded in the accounting system need to be added to the general ledger.

- Adjusting entries: These are journal entries that are made at the end of the month to correct any errors or omissions in the financial records.

- Reviewing financial statements: The financial statements such as the balance sheet, income statement, and cash flow statement are reviewed to ensure accuracy and completeness.

- Closing the books: The books for the previous month are closed by posting any necessary closing entries and adjusting entries. This ensures that the financial records are complete and up to date.

The month-end close process is typically done within a few days after the end of the month. A well-managed month-end close process ensures that the company’s financial records are accurate and up to date, which is critical for making informed business decisions, complying with regulatory requirements, and maintaining the confidence of investors and other stakeholders.

Don’t let the complexity of financial closing overwhelm you. For personalized guidance and expert advice on managing your month-end processes, reach out to us. Our team is ready to help you enhance your financial operations and decision-making.