In Canada, dividends paid out by corporations fall into two categories: eligible dividends and non-eligible dividends. This distinction is significant because it determines how dividends are taxed for shareholders. For small business owners, understanding these differences is crucial for effective tax planning and maximizing financial efficiency.

Who’s “eligible vs. non-eligible dividends” for?

- Small and medium-sized business owners

- Canadian-controlled private corporations (CCPC)

- Entrepreneurs looking to optimize their taxes

Why does eligible and non-eligible dividends matter to me?

Understanding the difference between eligible and non-eligible dividends matters because it can impact your tax liabilities. Incorrectly reporting dividends may result in tax penalties.

TLDR:

In Canada, small business owners must accurately report eligible (higher tax credit) and non-eligible dividends (lower tax credit) to avoid CRA penalties. Issue proper T5 slips, approve dividends with a directors’ resolution, and correct errors promptly.

What Are Eligible and Non-Eligible Dividends?

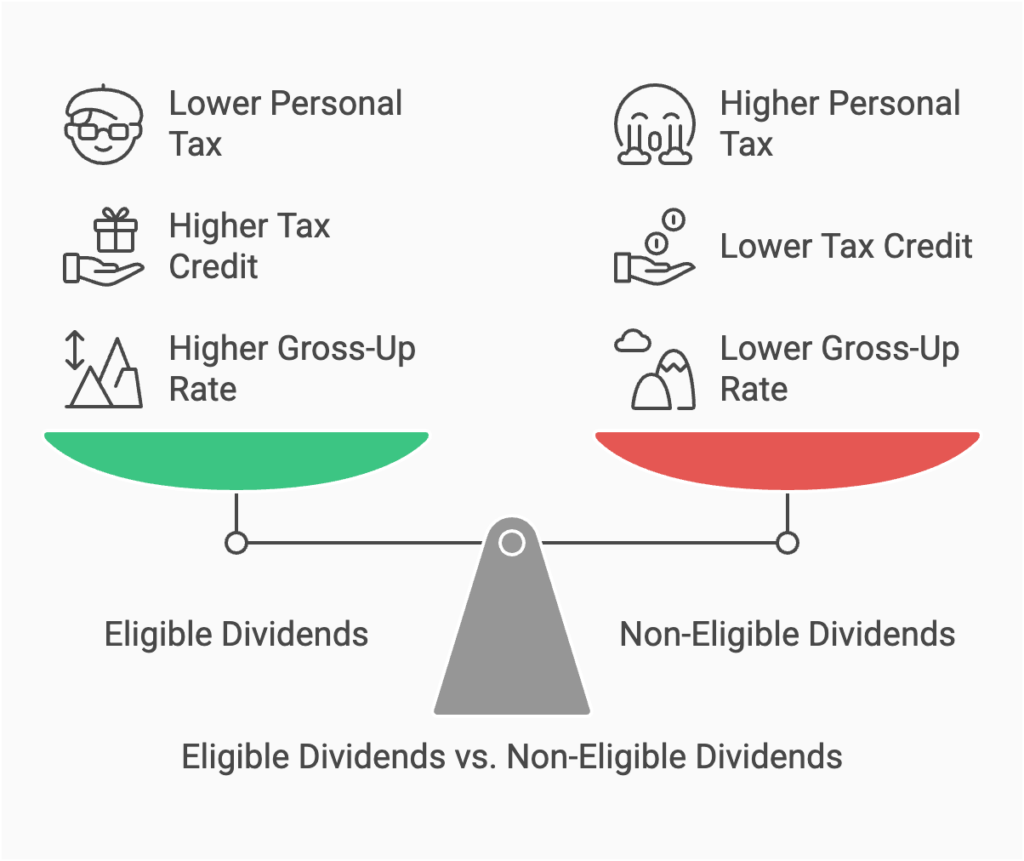

Eligible Dividends

Eligible dividends are paid by corporations from income that has been taxed at the general corporate tax rate. These dividends are subject to a higher gross-up (38%) and come with a higher dividend tax credit, resulting in lower personal tax rates for shareholders.

- Sources:

- Income above the small business deduction limit ($500,000 federally).

- Larger corporations or income taxed at higher rates.

Non-Eligible Dividends

Non-eligible dividends are paid from income taxed at the lower small business tax rate. These dividends have a lower gross-up (15%) and a lower dividend tax credit, meaning shareholders face higher personal tax rates compared to eligible dividends.

- Sources:

- Income earned within the small business deduction limit.

- Passive investment income earned by small businesses.

Learn more about optimizing your tax strategy today to maximize your business’s growth and profitability.

Why Accurate Reporting of Dividends Matters for Small Business Owners

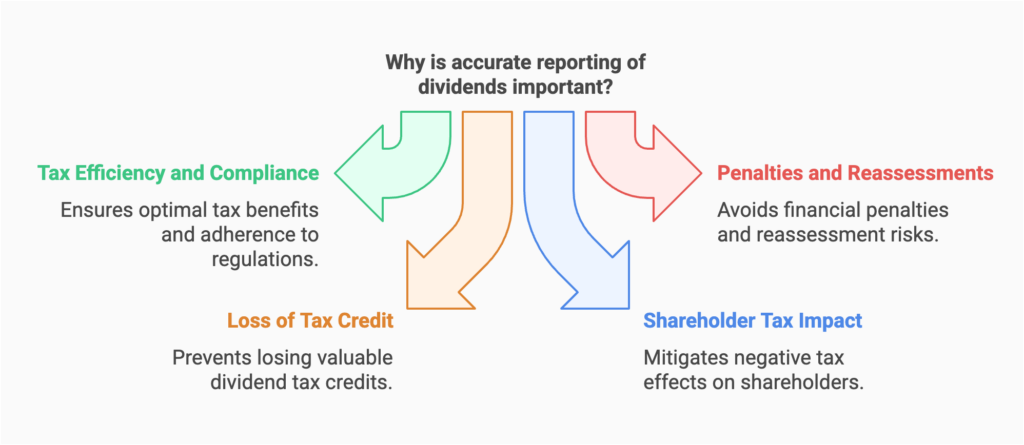

Misreporting dividends as eligible or non-eligible can lead to several significant consequences for small business owners. Understanding the tax implications of incorrect reporting is essential for avoiding financial and legal risks.

Tax Efficiency and Compliance

Correctly reporting dividends ensures that both the corporation and the shareholders are taxed appropriately. If you incorrectly report the dividend type:

- Eligible dividends may be mistakenly reported as non-eligible, meaning you forfeit the higher dividend tax credit and face a higher tax rate.

- Non-eligible dividends might be reported as eligible, which could result in you claiming a tax credit you’re not entitled to, triggering an audit or reassessment by the Canada Revenue Agency (CRA).

This misclassification could lead to you or your shareholders paying more taxes than necessary or claiming unqualified tax benefits, which could trigger penalties.

Penalties, Interest, and Reassessments

The CRA is vigilant in ensuring that income and dividends are correctly reported. If you misreport eligible vs non-eligible dividends, the CRA may:

- Impose penalties: You could be penalized for underreporting income, even if it was unintentional.

- Charge interest: On any unpaid taxes resulting from misreporting.

- Initiate an audit or reassessment: If the CRA finds discrepancies, they may reassess your tax return, requiring you to pay back taxes, penalties, and interest.

If the misreporting results in a significant tax liability, you could be subject to additional scrutiny, including audits or investigations.

Loss of Dividend Tax Credit

The dividend tax credit is essential for reducing personal taxes on dividend income. If you misreport:

- Eligible dividends as non-eligible: You lose out on the higher dividend tax credit, resulting in a higher tax burden for shareholders.

- Non-eligible dividends as eligible: You may receive a tax credit you aren’t entitled to, leading to a reassessment, penalties, and the requirement to repay the credit.

Shareholder Taxation Impact

For small businesses with multiple shareholders, incorrect dividend reporting can have a broader impact:

- Shareholders might overpay taxes if they were expecting a higher dividend tax credit (for eligible dividends) and instead receive a lower credit for non-eligible dividends.

- If dividends are incorrectly classified, shareholders may also file incorrect tax returns, leading to confusion and potentially costly mistakes.

Proper dividend reporting is crucial to avoid costly mistakes—that’s why having a trusted accountant is essential. Our Accounting & Tax Services are designed to help keep your business compliant and tax-efficient.

T5 Slip Preparation and Directors’ Resolutions for Dividends

As a small business owner, it’s important to follow proper procedures when declaring and distributing dividends, and part of that process involves the preparation of T5 slips and directors’ resolutions.

T5 Slips

A T5 slip is used to report dividend income paid to shareholders. If your corporation pays dividends, it must issue a T5 slip to each shareholder who receives dividends, which reports the amount of income earned from dividends.

- For Eligible Dividends: The T5 slip will report the grossed-up amount and the dividend tax credit.

- For Non-Eligible Dividends: The T5 slip will report the lower gross-up and the corresponding tax credit.

Ensure the T5 slip is correctly prepared and filed with the CRA by the required deadlines, which is typically February 28 of the year following the dividend payment. Failing to issue accurate T5 slips can result in penalties.

Directors’ Resolutions

When declaring dividends, the board of directors must pass a directors’ resolution that formally approves the dividend payout. This resolution is important for several reasons:

- It ensures that the dividend payment is legally authorized.

- It helps in ensuring the corporation adheres to legal and tax requirements.

- It provides a clear record for tax purposes, should the CRA request documentation in the future.

If you need help with dividend documentation? Book a free consultation with us!

Conclusion

Correctly reporting eligible and non-eligible dividends is vital for small business owners in Canada to ensure tax efficiency, compliance, and protection against costly errors. To avoid dispute, always classify dividends accurately on tax filings, issue proper T5 slips, and document directors’ resolutions approving dividend payments. Seeking professional guidance can help you navigate the complexities of tax regulations and maintain compliance.

If you’re uncertain about the process, Contact us today to stay compliant and optimize your financial strategy. For more insights, especially on the benefits of incorporating in Canada, check out our blog.