Intermediate Accounting

We continue our accounting series as a way to help any business owner or staff quickly grasp some fundamental accounting knowledge. It should be a quick read, intended more to highlight a few areas that we think needs your attention.

WHO IS THIS FOR?

This is intended for a bookkeeper or full charge accountant role or higher. As a pre-requisite try this series’ “1 or 3”, basics of accounting. The following is intended for educational purposes only. Consult a Chartered Professional Accountant.

KNOWLEDGE

Chart of Accounts (COA). Think of this as the back bone to your accounting books. It holds all the accounts used in accounting. Some call these accounts the general ledger (GL) accounts. Creating the right accounts to suit your business is crucial and luckily most accounting packages come with default COAs that will suit your business. Familiarize yourself with the COA, create a guide to keep consistency while posting transactions (i.e. Telus goes to Telephone & Internet, not Utilities), and finally, create policies to prevent the creation or removal of accounts.

Keep the COA simple and concise. Post transactions to the COA consistently.

Want to see the COA visually? Scroll to the middle of this Quickbooks presentation.

Product and Services. A list of what you sell and sometimes purchase. It could be physical products or a service. When fully setup, it can have default pricing, sales taxes, and a effect on the transactions in the General Ledger, so therefore it is very important to design this correctly from the start. Look to your business plan when creating this in your accounting system.

Similar to the Chart of Accounts, create a policy on prevent the creation or removal of these product & service items.

Protect the Chart of Accounts and Product & Services lists of your accounting system.

Create a master map or guide to help people throughout the organization on how to use and code transaction. The owner or controller should own this function.

Make it easy to understand, code, and have at least an annual review to make it’s effective and efficient.

Journal entries. A way to post a transaction in a double entry accounting format. It’s a useful way to post and balance unusual transactions without having to create a one-off GL account. Try to use journal entries sparingly and instead use the system invoices, cash receipts, bills, and expenses, etc.

Generally Accepted Accounting Principles (GAAP). This is a catch-all phrase for the framework of broad guidelines, conventions, rules and procedures of accounting. Everything you read here can be summarized as part of GAAP. In Canada, GAAP has evolved into International Financial Reporting Standards (IFRS) and Accounting Standard for Private Enterprises (ASPE). As you can imagine, each person will have their own way of setting up the books. GAAP standardizes the books so financial information can be comparable from your business to the next (if a third party, like a banker, would want when reviewing several a day).

MAJOR ACCOUNTING PRINCIPLES AND CONCEPTS

There are 10 fundamental accounting principles and concepts. We started with three in the basic series. Here we have four more.

Consistency principle: All accounting principles and assumptions should be applied consistently from one period to the next. This ensures that financial statements are comparable between periods and throughout the company’s history.

Historical cost principle: Requires companies to record the purchase of goods, services, or capital assets at the price they paid for them. Assets then remain on the balance sheet at their historical amount.

Revenue recognition principle: Revenue is recorded when it is earned regardless when receiving payment.

Going concern concept: Businesses (and its accounting) are treated as if it will continue to exist and operate in future periods. Thus, we should assume that there will be another accounting period in the future.

ASSETS

In the first series, we introduced two major components of assets. Here we expand on them and introduce a few more asset accounts.

Bad Debts (to Accounts Receivables). Happen when you cannot collect on a balance due. At every period-end determine the likelihood of collection and if there is a reasonable doubt on collecting an invoice, write it off as bad debt expense. To meet accounting principles, consider two methods: direct method; and allowance method. Select a method as policy and consistently use it every year.

Furniture & fixtures. A capital asset account that includes furniture, appliances, and tools costing $500 or more per tool, some fixtures, machinery, outdoor advertising signs, and equipment you use in the business. When creating and booking assets to this account, consider the Canada Revenue Agency’s CCA classes.

Property, plant and equipment. As the name implies, but create separate capital accounts if you have different types of these assets (look to CRA CCA classes to help separate) as it will be easier to file and report on these different assets come tax time.

Employee advances. There may be occasional times when lending funds to an employee for repayment, usually within a year. One account can log all the money to lend and repayment but use the individual transaction’s memo to document any terms.

Investments (GICs, stock & bonds, etc.). Use separate accounts for each type of investment or account. Reconcile those accounts each period-end with the financial institution’s statements. Be careful as the Federal government Budget 2018 proposed new rules on passive income. When the income from investments goes above $50,000, contact your Chartered Professional Accountant.

LIABILITIES

We talk about some basic liability accounts in the first series. Here, we want to point out common issues with transacting liability accounts.

Rewards and cash back. Related to credit card reward and cash-back programs. Most times these are credited back to your balance owing, and there is likely chance this is like income.

Returns and vendor credits. Look the items returned and maintain consistency on processing the return. Returns are usually sending physical products back to the vendor. Vendor credits are usually for a deduction to current or future vendor bills because of goodwill. We see a lot of issues with these transactions.

Bonuses and dividends payable. Use separate accounts when creating payable liabilities for these situations. Try not to use the accounts payable (AP) account because separately tracking these transactions will make reporting them easier at year-end.

Bank loans and mortgages. Like investments, use separate accounts for each type loan or mortgage. It is also necessary to reconcile them at each period-end with supporting statements.

Important items to record are the lending institution’s documentation about length of the loan, interest rate, and all covenants. We cannot stress enough the usefulness of having a full loan amortization or repayment schedule.

EQUITY

Opening balance equity (or Retained Earnings – Beginning). Most times, this value is automatically calculated by your accounting system or your external accountant. A lot of trouble happens when starting a new bank or credit card, an opening balance is recorded to this account – which is incorrect. This account is the ending balance of the net retained earnings after the prior year-end is complete and adjusted, in other words, let the system or your external accountant adjust to this account. There should be very few, if any, involvement with this account at the operational level.

Common shares. There are many types of shares, common shares are just one of them. If there are many classes of shares or the size of the investment is large or complex, then use separate GL accounts. Consider how the shareholders would like to report on the shares of the company.

REVENUE

We made a simple mention of revenue in our first post and that was it. We wanted to keep it simple if all you do is offer a type of service or product, which most businesses do. We can call that active business income (ABI). If your business has other sizable income, such as dividends from other companies, rental or leasing income, then contact your Chartered Professional Accountant. However, we will continue with keeping things simple and talk about revenue in general, or active business income.

Separate revenue accounts for major areas of the business. For a mechanical services company, as an example, it may have a construction side and a service side to the business. Having separate revenue GL accounts will help track how much revenue was generated by the different departments.

Revenue contra accounts. Refunds and allowances are a common contra account, where deductions to income due to customer refunds are booked. You use such an account for customer discounts. The goal in having these separate contra accounts is being able to track such situations and see them in regular reporting.

Refunds. Making a sale will result in revenue. A refund is the opposite, a deduction of the revenue on the original sale. Using a Refunds & Allowances contra account shows a negative on the Income Statement. Usually the refund involves the same sales taxes as the original sale.

COST OF SALES

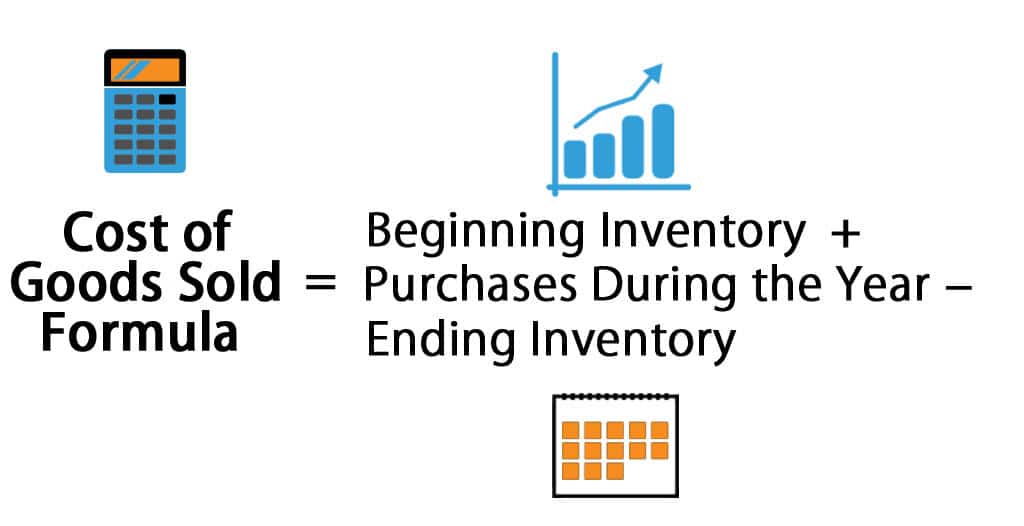

We touched on items or services you directly sell in the first post. Here we will expand on those with some thoughts around inventory and other direct costs. Recall, Cost of Sales (COS) can be called Cost of Goods Sold (COGS), are costs that have a direct, one-to-one relationship, with the sale. Doing this consistently will help in determining gross profit.

Opening inventory. Or last period’s ending inventory. Recall, inventory is a balance sheet account and is the cost of the stuff you hold before selling it. When you sell something it becomes Cost of Goods Sold (COGS), an income statement item. Therefore, tracking inventory and regularly updating your accounting books is essential in determining the profit on the sale.

Purchases and materials. If you purchase something for sale later and put in the warehouse, perhaps this should be posted to the inventory account. If purchase something for sale in the same period (same month) or next period, then post the expense to this COGS account.

Direct labour and subcontractors. Any human capital work related to the job can expense to this COS account.

Overhead and Other direct costs. Look to activity based costing or other methods to cost overhead expenses as direct cost. Consider the effort versus to benefit in evaluating these costs with your sales. Not many small businesses apply overhead costs to this COS area on the income statement because the effort sometimes is too great.

Closing inventory. We started with opening inventory and after accounting for purchases and net sold inventory you will arrive at closing inventory. At period-end it is also a good idea to do a physical inventory count to make sure what is reported on the financial statements is physically there.

OPERATING EXPENSES

We will expand on allowable expenses and the accounts normally found in the operating expenses (or general and administrative) section of the Income Statement. Look to the issues we note below and things to spot when using these accounts.

Amortization expense. At period end calculate amortization (or depreciation) of the capital assets and post it here. Amortization and Capital Cost Allowance may or may not be the same, it’s important choose the method based on the business and asset type plus consider how it will be calculated for CCA at year-end.

Business taxes. This could include property taxes or other related business taxes. When reporting these to another party is important, consider separate accounts.

Professional fees. Usually for legal and/or accounting fees. Important to note what the fees are for on each of payments.

Charitable or political donations. There are many rules surrounding donations and as a result a popular audit for CRA. Therefore, notate and keep all records handy if this is reviewed.

Stationary. Or otherwise known as Office Expense. There are many office expenses, make sure to keep expenses consistent to these and all accounts. Auditors know that many businesses use this account to hide other expenses.

Rent or lease. If you have several rental or lease agreements, consider separate accounts or a sub-ledger of accounts.

Repairs & maintenance. Generally, can include anything related to the upkeep of the physical property, such as repainting doors, walls, and ceilings. Even weekly cleaning or disposal fees for the garbage.

Payroll expenses. For employee gross salary, wages, and vacation pay.

Payroll benefits. We suggest having a separate account for employee benefits. This way it will help understand the ratio of benefits to wages.

Travel. From parking fees to ferry rides to hotel overnight stays; generally anything travel related to generating income for the business.

Utilities. Gas, hydro, telephone, mobile phone subscriptions, and internet subscriptions can go here.

Vehicle. Vehicle lease, vehicle insurance, and gas. For all company vehicles, be sure to track mileage and report it on a regular basis (ie. monthly).

OTHER INCOME AND EXPENSES

Historical cost and adjusted cost base. We will mention it here because we find that as businesses grow you acquire and dispose of capital assets (like large machinery or production equipment). Keeping good records and making correct accounting entries will help you determine any capital gain or losses on these items. To calculate a gain or loss it’s important to have the correct historical cost.

COMPLIANCE

We have noted several accounts and some important areas to focus on, for instance, charitable and political donations. Booking the transactions with good notation and memos will help but the supporting documentation are of primary importance.

If you do not have a filing cabinet, we give all our regular bookkeeping plan clients an 8 to 12 -pocket expanding file folder. Each pocket is labeled for the type of transaction and every receipt you receive goes into this folder for organization.

Strong organization is not just a good business practice but it can greatly reduce your compliance risk plus it can increase your administrative efficiency exponentially if done consistently and over a long period of time.