A Health Spending Account (HSA) is one of the most flexible and tax-efficient ways for Canadian business owners to provide healthcare benefits—for themselves, their families, and their employees.

If you’re a small business owner exploring alternatives to group health plans or looking for a smarter way to pay for medical expenses, understanding how an HSA works can help you design a cost-effective and personalized benefits plan.

What Is a Health Spending Account (HSA)?

A Health Spending Account (HSA) is a tax-free benefit plan that allows incorporated business owners and their employees to pay for eligible medical and dental expenses using pre-tax dollars from the company.

In other words:

- The corporation pays for medical expenses directly as a business deduction.

- The individual receives the reimbursement tax-free.

This setup turns personal after-tax health costs into legitimate business expenses—especially advantageous for owner-managed corporations.

Who Can Set Up an HSA?

An HSA can be established by incorporated businesses in Canada—this includes professional corporations, consultants, and small businesses.

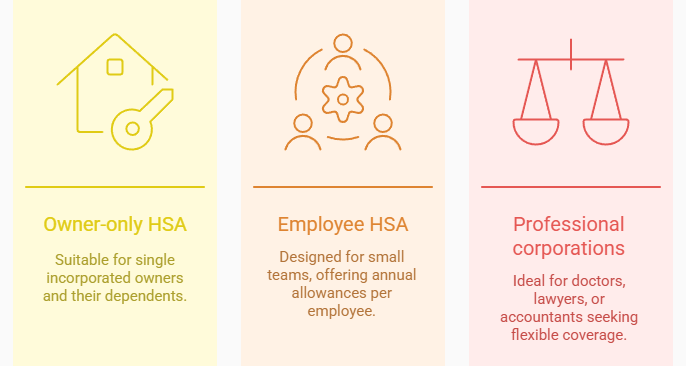

Common setups include:

- Owner-only HSA: For a single incorporated owner and their dependents.

- Employee HSA: For small teams, with annual allowances per employee.

- Professional corporations: For doctors, lawyers, or accountants seeking flexible coverage.

Note: Sole proprietors may still qualify under a Private Health Services Plan (PHSP) model, but deductions are more limited than for incorporated owners.

HSA vs PHSP vs Group Benefits: Key Differences

| Feature | Health Spending Account (HSA) | Private Health Services Plan (PHSP) | Traditional Group Benefits |

| Funding | Self-funded by employer | Similar structure | Fixed monthly premiums |

| Flexibility | High – employer sets limits | Moderate | Low – fixed coverage tiers |

| Tax Treatment | 100% deductible to employer, tax-free to employee | Same | Same |

| Administrative Cost | Low | Low to moderate | High (insurance overhead) |

| Best For | Small to mid-sized incorporated businesses | Unincorporated professionals | Larger teams needing pooled risk coverage |

In short:

- A HSA is a type of PHSP that provides clearer cost control and flexibility.

- A group plan still makes sense for pooled drug or disability coverage.

When Does Having Group Benefits Outweigh an HSA?

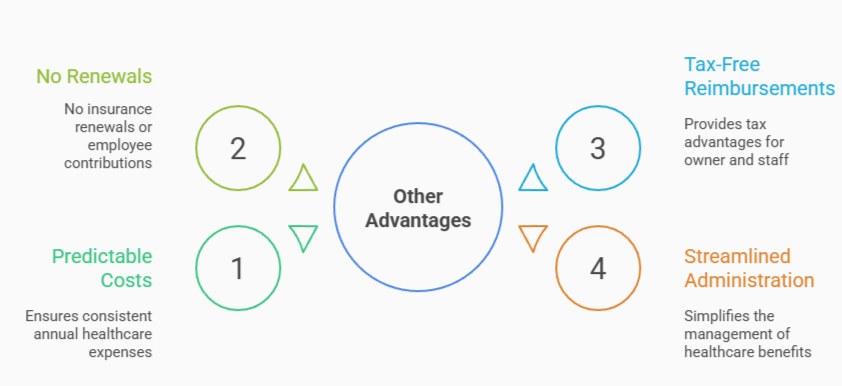

While HSAs are ideal for flexibility and predictability, group benefits make more sense when you want pooled insurance and employee retention features.

| Situation | Recommended Option |

| 1–5 employees, mostly family members | HSA – flexible and cost-effective |

| 5–10+ employees needing predictable coverage | Group Benefits – pooled plan for stability |

| High recurring prescription or disability risk | Group Benefits |

| Owner wants to cap health costs | HSA |

| Desire for traditional insurance feel | Group Benefits |

Many businesses use a hybrid approach: a basic group plan for core coverage and an HSA for additional or out-of-pocket expenses.

Case Studies: Small Business & Corporate Use of HSAs

For incorporated small business owners, HSAs offer a clear tax advantage.

Example: If you pay $3,000 personally for dental and vision care, you might need roughly $5,000 in pre-tax income to cover it after tax. With an HSA, that same $3,000 is reimbursed tax-free and fully deductible to the corporation — saving 25–40% depending on your tax rate.

What Can Be Claimed Under an HSA?

Most expenses eligible for the CRA’s Medical Expense Tax Credit (METC) can be reimbursed through an HSA.

Eligible examples include:

- Dental (cleanings, orthodontics, implants)

- Prescription drugs

- Vision (glasses, contacts, laser surgery)

- Physiotherapy, chiropractic, and massage

- Mental health counselling

- Fertility treatments

- Medical equipment (orthotics, braces, hearing aids)

- Private health insurance premiums

Tip: If your family spends several thousand dollars yearly on medical or dental care, using an HSA can make those same costs 20–40% cheaper after tax.

Step-by-Step: How to Set Up an HSA in Canada

To qualify as a Private Health Services Plan (PHSP) under the Income Tax Act, your HSA must meet certain CRA conditions:

- The plan must cover medical and hospital expenses as defined under s.118.2(2) of the Income Tax Act.

- The plan must be formally documented, either through a third-party provider or an internal written policy.

- Benefit limits must be reasonable and consistent among similar employee classes.

- Reimbursements must flow through the corporation—not directly from the owner’s personal account.

Most business owners use a third-party HSA provider. These providers handle claims processing and ensure CRA compliance for a small administrative fee—typically 5–10% of each claim. Using a provider helps avoid CRA challenges, simplifies documentation, and ensures the plan qualifies as a legitimate PHSP.

Is It More Beneficial to Set Up an HSA or Claim a METC on My Personal Tax Return?

Both the HSA and the Medical Expense Tax Credit (METC) help reduce healthcare costs, but they work differently:

| Feature | Health Spending Account (HSA) | Medical Expense Tax Credit (METC) |

| Who can use it | Incorporated business owners and employees | Any individual taxpayer |

| Tax treatment | 100% business deduction for corporation | Non-refundable personal tax credit |

| Value of tax relief | Typically 25–40% (depending on corporate tax rate) | 15% of eligible expenses exceeding 3% of net income |

| Cash flow | Reimbursement from company | Claimed at year-end on personal return |

| Eligible expenses | Similar to CRA’s METC list | Same list |

| Best for | Incorporated owners or businesses with predictable health costs | Unincorporated individuals or those without a corporation |

In general:

An HSA almost always provides greater tax efficiency than claiming the METC personally, as the full expense is deductible at the corporate level, not just partially credited.

FAQ: Common Questions About Health Spending Accounts

Q: Can I set up an HSA only for myself and not my employees?

A: Yes. Incorporated owners can set up a “class of one” plan for themselves and their dependents, provided there’s a formal written plan and reimbursement policy.

Q: Can I set up an HSA if I only take dividends?

A: CRA typically expects plan members to receive employment income (T4) to justify the benefit. If you only take dividends, consider adding a small salary to stay compliant.

Q: Can I set up a large allowance (e.g., $25,000 per year)?

A: CRA allows reasonable limits. Very large amounts may be seen as disguised compensation. Most owner plans range from $1,500–$5,000 per family member per year.

Q: What’s the difference between a PSA and an HSA?

A: A Health Spending Account (HSA) reimburses medical expenses only under CRA’s PHSP rules.

A Personal Spending Account (PSA) covers wellness and lifestyle expenses—like gym memberships, fitness programs, or ergonomic chairs—but is taxable to the employee. Some employers offer both as part of flexible benefit programs.

Q: Can I administer my own HSA program?

A: Yes, but we do not recommend it. Self-administration requires careful documentation, receipts, and adherence to CRA definitions. Using a third-party administrator is strongly recommended to ensure compliance and proper recordkeeping.

Q: Can I set up an HSA if I’m an owner-operator and the sole employee?

A: Yes. If your business is incorporated and you receive T4 employment income, you can set up a “Class of One” HSA for yourself and your dependents. The corporation can deduct eligible medical expenses as a business expense while you receive the reimbursement tax-free, provided the plan is properly documented and reasonable in amount.

Conclusion

A Health Spending Account (HSA) can be one of the most tax-efficient and flexible benefit options for incorporated business owners. It helps transform personal healthcare costs into legitimate business deductions, supports employee wellbeing, and reduces after-tax expenses. However, compliance and plan design matter. Setting reasonable limits, maintaining documentation, and working with a reliable provider ensure your HSA remains CRA-approved.

At Purpose CPA, we help Canadian business owners structure their compensation and benefits to maximize after-tax value and peace of mind.